Overview

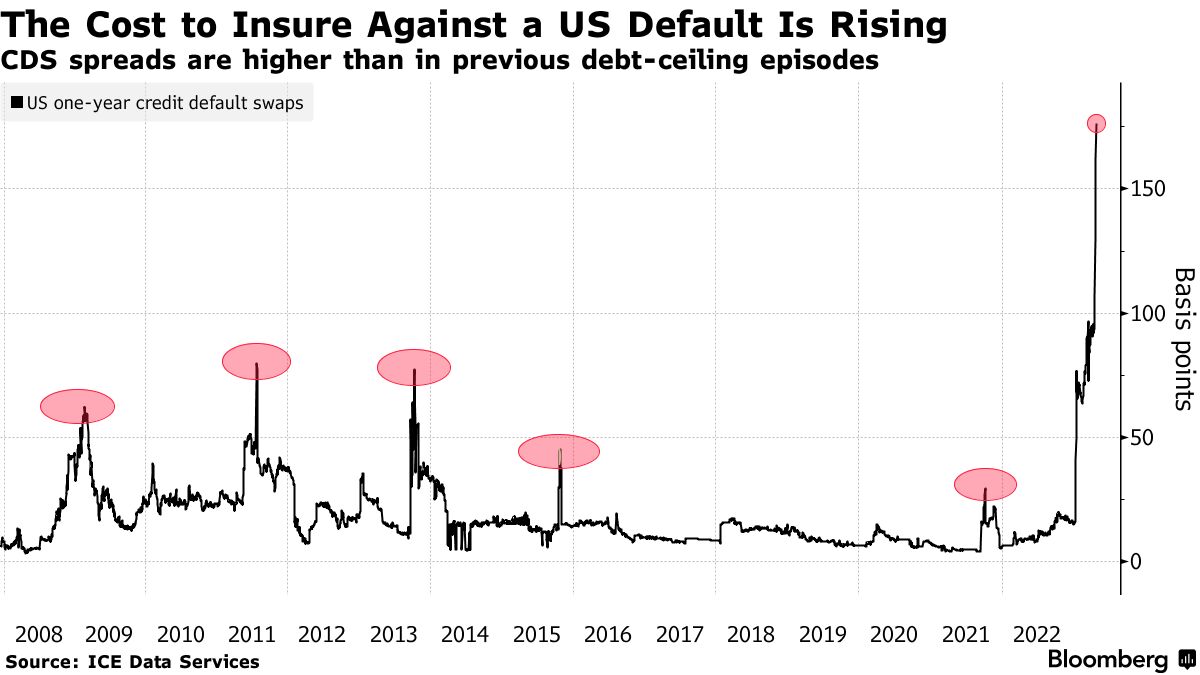

As the U.S. Congress clashes over raising the federal borrowing limit, investor anxiety has surged, pushing up the cost of insuring Treasury debt via credit default swaps (CDS). Spreads on one-year and five-year U.S. sovereign CDS have widened sharply, reflecting market fears of a potential default if the debt ceiling isn’t lifted on time (金融时报). This article explains how the political standoff directly drives CDS spreads higher, what the moves imply for default risk, and why both bond and equity investors are watching these gauges closely.

1. Political Gridlock and Default Risk

When lawmakers fail to agree on a debt-limit increase, Treasury Secretary Scott Bessent warns of an imminent “X-date” when the government exhausts its cash and extraordinary measures (金融时报). Each high-stakes deadline renews calls for risk hedging, leading investors to buy CDS protection. The volume of U.S. sovereign CDS outstanding has climbed to $3.9 billion, up from $2.9 billion earlier this year (Reuters).

2. How CDS Spreads React

2.1 Short-Term vs. Long-Term Spreads

Short-term (six-month to one-year) CDS spreads have widened to around 70 basis points, up from 65 bps just days before (Reuters). Five-year CDS, which price longer-term default risk, have also jumped roughly 20 bps, signaling that markets see meaningful default probability if the impasse drags on (The Real Economy Blog).

2.2 Deliverable Bond Dynamics

CDS contracts allow holders to deliver the cheapest-to-deliver Treasury bond in a default auction. As the price of long-dated bonds falls amid political uncertainty, the implied loss given default increases, further widening CDS spreads even if outright default probability remains low (芝加哥联邦储备银行).

3. Market Implications

3.1 Bond Yields and Borrowing Costs

Broader Treasury yields tend to rise alongside CDS spreads, as hedging flows push prices down. Recent data show the 10-year Treasury yield climbing toward 4.20% amid the standoff (KITCO), increasing borrowing costs for corporates and consumers alike.

3.2 Flight to Quality and Equity Volatility

Wider CDS spreads and higher yields often coincide with equity market turbulence. Investors rotate into cash and safe-haven assets, spiking the CBOE Volatility Index (VIX) and weighing on stock valuations .

4. What to Watch Next

Congressional Negotiations: Progress or brinkmanship on Capitol Hill will be the primary driver of CDS and Treasury moves.

X-Date Revisions: Any shift in Treasury’s estimated default timeline can trigger abrupt re-pricings in CDS spreads.

Federal Reserve Comments: Fed officials’ tone on fiscal stability may influence both bond yields and default hedging costs .

Conclusion

The U.S. debt-ceiling debate has transcended politics, becoming a key determinant of credit default swap spreads. As spreads reach levels unseen since prior debt-limit clashes, they offer a barometer of market stress and default perceptions. Monitoring these spreads alongside Treasury yields and political developments is essential for understanding the evolving risk landscape.

Tags:

FinHub365

Global Financial News & Market Trends – finhub365

Stay informed with the latest financial news, market trends, and personal finance tips from around the world. Discover insights and analysis 24/7 on finhub365.