Overview

The recent U.S.–China trade talks in Geneva have injected fresh uncertainty into equity markets, with the S&P 500 experiencing heightened intraday swings. While negotiators aim to ease tit-for-tat tariffs—recently as high as 145% U.S. and 125% Chinese—investors are watching how even modest progress could calm bond yields and equity volatility. This article examines key drivers of the S&P 500’s choppiness amid Geneva negotiations, implications for market participants, and what to expect next.

1. Background on Geneva Trade Talks

The U.S. delegation, led by Treasury Secretary Scott Bessent, resumed face-to-face negotiations with Chinese officials in Geneva on May 10–11, 2025, after aggressive tariff hikes from both sides strained trade relations. Despite no major breakthroughs, President Trump heralded “very good” discussions and hinted at potential tariff rollbacks to 80% from 145%, underscoring the high stakes for global commerce.

1.1 Tariff Context

- U.S. tariffs: Up to 145% on select Chinese imports.

- China’s retaliation: 125% on American goods.

- Negotiators are exploring phased reductions to as low as 50%–60% to boost trade volumes .

2. Impact on S&P 500 Volatility

2.1 Volatility Metrics

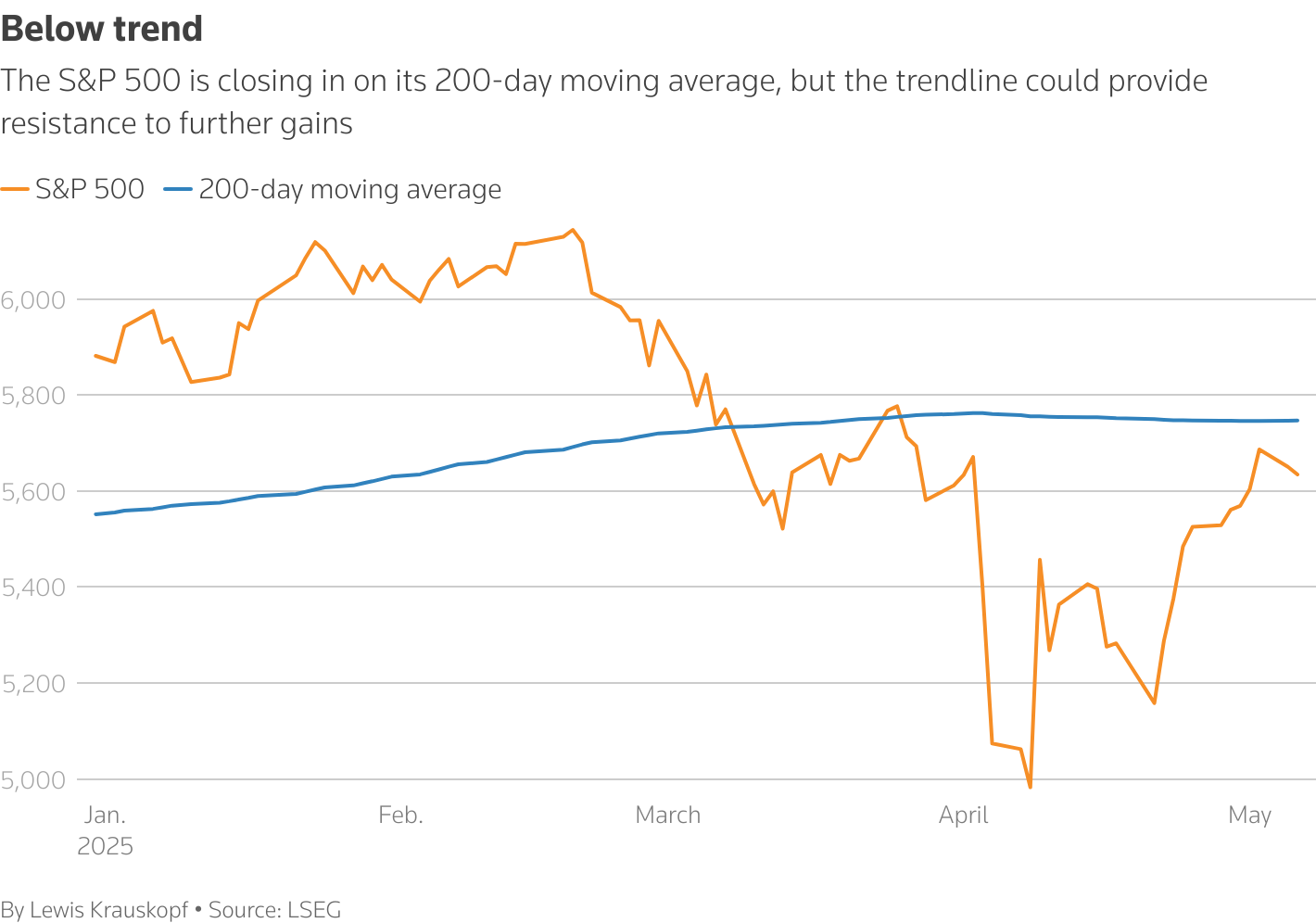

The CBOE Volatility Index (VIX) spiked by over 15% on May 9, reflecting market nerves as traders priced in uncertain outcomes . The S&P 500’s 200-day moving average acted as resistance, with the index oscillating around this benchmark amid tariff headlines .

2.2 Sectoral Drivers

- Tech & Semiconductors: Chip stocks rallied late in the week, lifting the Nasdaq but fueling S&P 500 swings as investors weighed export restrictions.

- Industrial & Materials: Firms with significant China exposure saw amplified price moves on commentary about potential chemical export curbs.

3. Bond Yields and Equity Correlation

Treasury yields briefly dipped following news that talks could de-escalate, demonstrating the tight linkage between fixed income expectations and equity volatility . A pause in Fed rate hikes further cooled 10-year yields, which in turn tempered equity risk premiums.

4. Investor Sentiment and Positioning

Surveys indicate a cautious stance: U.S. stock futures trading volumes rose by 20% on uncertainty days, while put/call ratios hit year-to-date highs . Portfolio managers report underweight positions in U.S. large-caps, awaiting clearer tariff paths .

5. What Comes Next?

- Further Rounds: Talks will likely continue, with China expected to firm on core principles, including no forced technology transfers .

- Market Reaction: Even minor tariff reductions could spark a relief rally; however, incomplete agreements may sustain volatility near 20% annualized levels.

- Watchpoints:

- Official communiqués from Beijing and Washington.

- U.S. weekly jobless claims for signs of economic resilience.

- Corporate earnings ahead of Q2 guidance updates.

Conclusion

The Geneva trade talks have underscored how geopolitics drives market turbulence. For equity investors, understanding the interplay between tariff developments, Treasury yields, and sector exposures remains crucial. As negotiators inch toward potential rollbacks, the S&P 500’s path to sustained stability will depend on tangible commitments and clear timelines from both sides.